Introduction: Africa’s Golden Beverages Transforming Global Markets

Africa produces over 12% of the world’s coffee and is rapidly emerging as a premium tea powerhouse, yet many consumers worldwide remain unaware of the continent’s extraordinary contribution to their daily cup. From the legendary coffee origins of Ethiopia to the high-altitude tea gardens of Rwanda, Africa’s coffee and tea industry represents not just agricultural excellence, but a profound cultural heritage spanning millennia.

This comprehensive guide explores the current state of Africa coffee production, delves into the East Africa tea industry dynamics, and provides essential coffee tea export statistics that reveal why savvy investors and industry professionals are turning their attention to the continent’s brewing revolution.

What makes Africa’s coffee and tea industry unique? Beyond the exceptional quality and diverse flavor profiles, African producers are pioneering sustainable farming practices, direct trade relationships, and innovative processing methods that are reshaping global beverage standards.

Understanding Africa’s Coffee Production Landscape

Current Production Statistics and Key Regions

Africa coffee production has experienced remarkable growth, with the continent now producing approximately 23 million 60-kilogram bags annually. This represents a steady increase from previous decades, driven by both expanded cultivation and improved agricultural techniques.

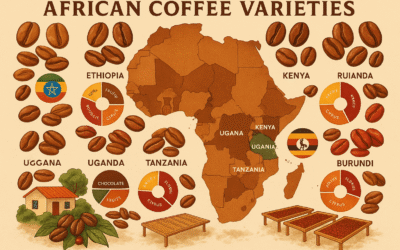

Top African Coffee Producing Countries:

- Ethiopia – 7.5 million bags (32% of African production)

- Home to coffee’s origins with over 1,000 years of cultivation history

- Renowned for complex, wine-like flavor profiles

- Leading organic and wild coffee production

- Uganda – 4.8 million bags (21% of African production)

- Fastest-growing coffee producer in East Africa

- Strong focus on sustainable farming practices

- Increasing specialty coffee market penetration

- Kenya – 0.8 million bags (3.5% of African production)

- Premium quality focus over quantity

- Internationally recognized auction system

- Leading innovations in processing methods

- Rwanda – 0.3 million bags (1.3% of African production)

- Remarkable post-conflict agricultural transformation

- Specialty coffee excellence with 85+ cupping scores

- Model for sustainable coffee development

The Africa Coffee & Tea Expo showcases these diverse origins, connecting producers directly with international buyers and highlighting the continent’s quality evolution.

Quality Revolution and Market Positioning

African coffee has undergone a quality revolution over the past two decades. Countries like Rwanda have transformed from producing commodity-grade coffee to achieving specialty coffee recognition with consistent 85+ cupping scores. This shift represents:

- 30% average price premium for African specialty coffees

- Growing direct trade relationships eliminating traditional intermediaries

- Increased farmer income through quality-focused production

- Enhanced global recognition of African coffee origins

According to the International Coffee Organization (ICO), African specialty coffee exports have grown by 45% over the past five years, indicating strong market demand for premium African origins.

East Africa Tea Industry: The Rising Powerhouse

Regional Production and Export Dynamics

The East Africa tea industry has emerged as a global force, with the region producing over 750,000 metric tons of processed tea annually. This represents approximately 23% of global tea production, making East Africa the world’s largest tea-producing region by volume.

Leading East African Tea Producers:

Kenya leads the region with 550,000 metric tons annually, making it the world’s third-largest tea producer. Kenyan tea is renowned for:

- High-grown quality from altitudes above 2,000 meters

- CTC (Crush, Tear, Curl) processing excellence

- Strong export market with 95% of production exported

- Mombasa Tea Auction – world’s second-largest tea auction

Malawi contributes 60,000 metric tons annually, focusing on:

- Premium orthodox teas for international markets

- Sustainable farming certifications (Rainforest Alliance, Fair Trade)

- Smallholder farmer empowerment programs

- Unique terroir creating distinctive flavor profiles

Rwanda produces 28,000 metric tons annually with emphasis on:

- High-altitude tea gardens above 1,800 meters

- Premium quality positioning over volume production

- Integrated coffee-tea farming systems

- Emerging specialty tea market penetration

Market Trends and Future Projections

The East African tea industry is experiencing significant market transformation driven by:

Global Demand Shifts:

- Specialty tea segment growth of 15% annually

- Health-conscious consumer trends favoring natural products

- Premium packaging and branding initiatives

- Direct trade relationships bypassing traditional auction systems

Export Market Diversification:

- Traditional markets: UK, Pakistan, Egypt (60% of exports)

- Emerging markets: USA, Germany, Japan (25% growth annually)

- Regional African markets: 15% increase in intra-Africa trade

- Online retail channels: New direct-to-consumer opportunities

The Food and Agriculture Organization (FAO) projects that East African tea production will grow by 5.75% annually through 2030, driven by expanding cultivation areas and improved processing technologies.

Coffee Tea Export Statistics: Understanding Global Trade Flows

Current Export Volumes and Value

Africa’s coffee and tea exports generate approximately $4.2 billion annually in foreign exchange earnings, representing a crucial economic sector for many African nations.

Coffee Export Statistics:

- Total volume: 18.5 million bags exported (80% of production)

- Average value: $2.85 billion annually

- Top destinations: Europe (45%), Asia (30%), Americas (20%)

- Growth rate: 3.2% annually over the past decade

Tea Export Statistics:

- Total volume: 680,000 metric tons exported (91% of production)

- Average value: $1.35 billion annually

- Top destinations: Pakistan (25%), UK (20%), Egypt (15%)

- Growth rate: 5.1% annually over the past decade

Market Access and Trade Challenges

Despite strong production capabilities, African coffee and tea exporters face several market access challenges:

Regulatory Barriers:

- EU Deforestation Regulation requiring enhanced traceability

- Pesticide residue standards demanding investment in testing

- Organic certification costs limiting smallholder access

- Fair Trade compliance requiring organizational development

Infrastructure Limitations:

- Port efficiency affecting shipment timing and costs

- Storage facilities impacting quality preservation

- Transportation networks increasing logistics expenses

- Processing capacity limiting value addition opportunities

The upcoming ACT Expo 2025 in Kigali addresses these challenges by facilitating direct connections between African producers and international buyers, reducing traditional trade barriers.

Featured Snippet: Key Facts About Africa’s Coffee & Tea Industry

What are the key statistics for Africa’s coffee and tea industry?

- Coffee Production: 23 million bags annually (12% of global production)

- Tea Production: 750,000 metric tons annually (23% of global production)

- Export Revenue: $4.2 billion combined annual earnings

- Employment: 25+ million people across the value chain

- Growth Rate: Coffee 3.2%, Tea 5.1% annually

- Top Regions: East Africa leads both sectors with premium positioning

- Market Trend: Shift toward specialty products and direct trade relationships

Market Opportunities and Investment Potential

Emerging Investment Opportunities

The African coffee and tea sectors present compelling investment opportunities across multiple areas:

Value Chain Enhancement:

- Processing facility modernization improving quality and efficiency

- Packaging and branding initiatives for premium market positioning

- Quality testing laboratories ensuring international standards compliance

- Storage and warehousing facilities preserving product quality

Technology Integration:

- Precision agriculture technologies optimizing yields and quality

- Blockchain traceability systems meeting regulatory requirements

- Mobile payment platforms facilitating farmer transactions

- E-commerce platforms enabling direct consumer access

Sustainability Initiatives:

- Climate-smart agriculture adapting to environmental changes

- Renewable energy systems for processing facilities

- Water conservation technologies reducing environmental impact

- Carbon credit programs generating additional revenue streams

According to International Trade Centre (ITC) analysis, African coffee and tea sectors could attract $2.3 billion in investment over the next five years, driven by growing global demand for premium and sustainable products.

Future Market Projections

Industry analysts project significant growth potential for African coffee and tea:

Coffee Sector Projections (2025-2030):

- Production growth: 4.1% annually

- Export value increase: 6.2% annually

- Specialty market share: Growing from 15% to 35%

- Direct trade percentage: Increasing from 25% to 45%

Tea Sector Projections (2025-2030):

- Production growth: 5.75% annually

- Premium segment expansion: 12% annually

- New market penetration: Focus on Americas and Asia

- Value-added products: Processing beyond basic tea leaves

Sustainability and Social Impact

Environmental Stewardship

African coffee and tea producers are increasingly embracing sustainable farming practices that benefit both the environment and local communities:

Conservation Initiatives:

- Shade-grown coffee systems preserving biodiversity

- Organic certification eliminating synthetic chemical inputs

- Water conservation techniques reducing environmental impact

- Soil health improvement through composting and natural fertilizers

Climate Adaptation:

- Drought-resistant varieties developed for changing conditions

- Altitude migration moving cultivation to optimal elevations

- Weather monitoring systems improving crop management

- Insurance programs protecting farmers against climate risks

Social Development Impact

The coffee and tea industries serve as economic anchors for rural African communities:

Community Benefits:

- Employment generation: 25+ million jobs across the value chain

- Income stability: Providing year-round economic opportunities

- Gender empowerment: Women’s cooperatives gaining market access

- Education funding: Premium prices supporting school construction

Cooperative Development:

- Farmer organizations strengthening collective bargaining power

- Shared processing facilities reducing individual investment costs

- Quality training programs improving production standards

- Market linkage facilitation connecting producers with buyers

The Rwanda Convention Bureau highlights how events like ACT Expo strengthen these social development outcomes by creating direct market access for African producers.

Conclusion: Africa’s Brewing Future

Africa’s coffee and tea industry stands at a transformative moment. With production statistics showing consistent growth, export markets expanding, and quality recognition increasing globally, the continent is positioned to capture greater value from its agricultural heritage.

The East Africa tea industry’s emergence as a global powerhouse, combined with Africa coffee production’s shift toward specialty markets, creates unprecedented opportunities for producers, investors, and industry professionals.

Key success factors moving forward include:

- Continued investment in quality improvement and processing infrastructure

- Strengthened direct trade relationships bypassing traditional intermediaries

- Enhanced sustainability practices meeting evolving consumer expectations

- Improved market access through events like ACT Expo facilitating connections

For coffee and tea enthusiasts, understanding Africa’s industry evolution enhances appreciation for the continent’s contributions to global beverage culture. For industry professionals, these trends represent significant business opportunities in one of the world’s most dynamic agricultural sectors.

Ready to Explore Africa’s Coffee & Tea Excellence?

Join the conversation and discover more about Africa’s remarkable coffee and tea journey. Connect with producers, explore new origins, and experience the continent’s brewing revolution firsthand.

Learn more about upcoming industry events and opportunities to engage with African coffee and tea producers at the Africa Coffee & Tea Expo.

Share this article with fellow coffee and tea enthusiasts to spread awareness of Africa’s incredible contributions to global beverage culture.