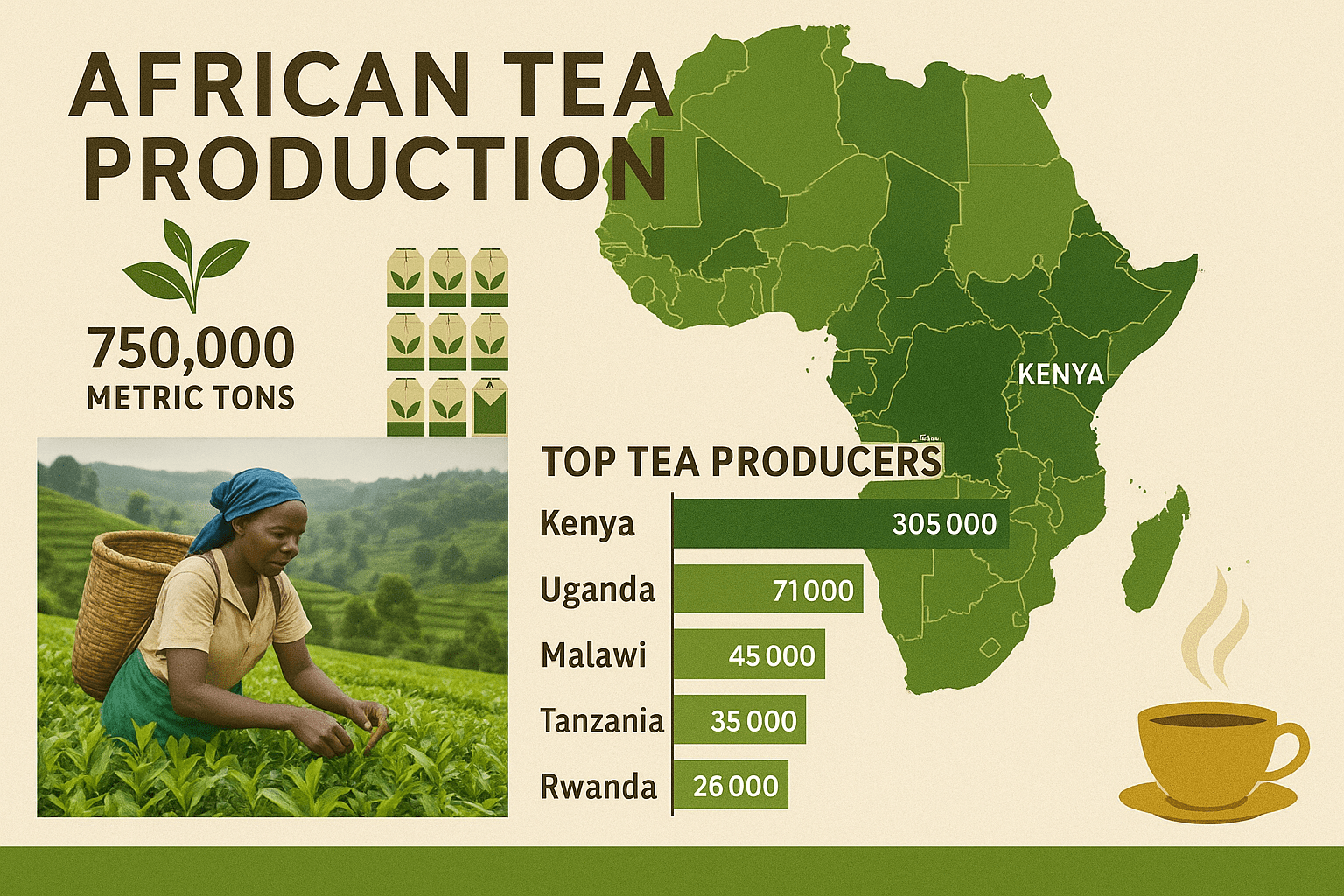

Africa has quietly emerged as a global tea powerhouse, producing over 750,000 metric tons annually and reshaping international markets with distinctive, high-quality teas that command premium prices.

Africa’s Rising Tea Empire: A Continental Success Story

When global tea production is discussed, China and India often dominate the conversation. Yet Africa has cultivated its own remarkable success story, producing over 750,000 metric tons of processed tea annually—a figure that represents significant economic value and supports millions of livelihoods across the continent.

This achievement isn’t just about volume; it’s about Africa carving a distinctive niche in the global tea market through quality, sustainability, and strategic market positioning. From Kenya’s robust CTC teas to Rwanda’s delicate orthodox varieties, African tea production has evolved into a sophisticated industry that combines traditional knowledge with modern innovation.

As the Africa Coffee & Tea Expo 2025 prepares to showcase this success in Kigali this July, let’s explore the data behind Africa’s tea triumph and what it means for the continent’s agricultural future.

Regional Powerhouses: Mapping Africa’s Tea Production

East Africa: The Continental Leader

Featured Snippet: Africa’s Top Tea Producing Countries

- Kenya: 459,000 metric tons (61.2% of African production)

- Uganda: 65,000 metric tons (8.7%)

- Tanzania: 35,000 metric tons (4.7%)

- Rwanda: 32,000 metric tons (4.3%)

- Malawi: 30,000 metric tons (4.0%)

- Other African nations: 129,000 metric tons (17.1%) Total African production: 750,000 metric tons annually

East Africa forms the backbone of the continent’s tea industry, with Kenya leading not just in Africa but ranking as the world’s third-largest tea producer behind China and India. According to the Kenya Tea Development Agency (KTDA), the country’s production has steadily increased over the past decade, driven by both smallholder farmers and large estates.

Rwanda, though smaller in volume, has established itself as a premium producer. The National Agricultural Export Development Board (NAEB) reports that Rwandan tea consistently achieves some of the highest prices at the Mombasa Tea Auction, averaging 15-20% above other regional teas due to its exceptional quality and distinctive flavor profile.

North and West Africa: Emerging Production Zones

While East Africa dominates production, countries like Morocco, Cameroon, and Nigeria are developing their own tea sectors, often focusing on specialty and value-added products for both domestic consumption and export.

The Food and Agriculture Organization (FAO) notes that these emerging regions benefit from studying established African producers, allowing them to implement advanced practices from the outset rather than following the typical development curve.

Economic Impact: Beyond Production Numbers

Employment and Livelihood Creation

The 750,000 metric tons figure represents far more than agricultural output—it translates to millions of jobs and livelihoods. In Kenya alone, the tea industry directly and indirectly supports approximately 5 million people, according to data from the Tea Research Institute.

A study by the International Labour Organization (ILO) found that tea production creates between 700-1,200 jobs per square kilometer of cultivation—significantly higher than many other agricultural activities, making it a crucial sector for rural development.

Export Revenue and Foreign Exchange

African tea exports generate over $1.5 billion annually in foreign exchange, providing crucial revenue for economic development. The International Tea Committee reports that African teas comprise approximately 32% of global exports despite representing only about 13% of production, highlighting the export-oriented nature of the continent’s tea industry.

Quality Revolution: Africa’s Premium Tea Transformation

Shifting from Volume to Value

While production volume is impressive, the true success story lies in Africa’s quality transformation. Over the past decade, African producers have increasingly focused on:

- Specialty tea production – Including orthodox, whole leaf, and artisanal teas

- Organic certification – Meeting growing global demand for chemical-free teas

- Value-addition – Developing consumer-ready branded products rather than selling bulk tea

- Geographical indication – Establishing unique regional identities for African teas

Mr. Enos Njiru Njeru, MD & CEO of the Kenya Tea Development Agency, explains: “The future of African tea lies not just in producing more but in producing better and capturing more value locally. We’re seeing significant premiums for quality-focused production.”

Climate-Positive Production

Africa has emerged as a leader in sustainable tea production, with initiatives that address climate change while improving quality. Projects like Ethical Tea Partnership’s climate adaptation programs in East Africa are helping smallholders implement practices that both reduce environmental impact and increase resilience.

According to Martin Short, Interim Executive Director of the Ethical Tea Partnership: “African tea producers are increasingly positioning themselves at the forefront of sustainable agricultural practices, recognizing that environmental stewardship and quality go hand in hand.”

Market Dynamics: Navigating Global Challenges

Price Volatility and Value Chain Control

Despite production success, African tea faces challenges including price volatility and limited control over the value chain. The Mombasa Tea Auction, while crucial to the regional industry, still sees significant price fluctuations.

Industry experts at the upcoming Africa Coffee & Tea Expo 2025 will address these challenges through sessions on “Market Access & Value Addition” and “Supply Chain Resilience”—critical conversations for securing the industry’s future prosperity.

Compliance with Evolving Regulations

New challenges like the EU Deforestation Regulations require strategic adaptation. Duncan Page, Director of The Wood Foundation Africa, notes: “Compliance with emerging sustainability regulations isn’t just about market access—it’s an opportunity for African producers to demonstrate leadership in responsible production methods.”

The Future: Africa’s Tea Production by 2030

Technology and Innovation Integration

With climate change threatening traditional growing areas, technological innovation has become essential. David Mutangana, Managing Director of Karongi Tea in Rwanda, emphasizes: “We’re implementing data-driven agriculture, from soil sensors to weather monitoring systems, that allow us to maintain quality while adapting to changing conditions.”

Youth Engagement and Modernization

The stereotypical image of tea farming as traditional and low-tech is rapidly changing as young entrepreneurs enter the sector. Initiatives like those led by Theopista Sekitto Ntale, Africa Ambassador for the Financial Alliance for Women, are helping transform tea production into an attractive sector for youth employment and innovation.

Conclusion: From Production Milestone to Market Leadership

Africa’s achievement of producing 750,000 metric tons of tea annually represents just the beginning of its potential. As the continent moves from volume-based production to value-oriented strategies, African tea is positioned to reshape global markets through distinctive quality, sustainability leadership, and increasing control over its value chain.

For stakeholders throughout the tea industry—from producers to buyers to investors—Africa represents not just a significant source of tea but an innovation hub that is pioneering approaches to the crop’s future in a changing climate and evolving market.

The upcoming Africa Coffee & Tea Expo 2025 in Kigali will showcase these developments, bringing together industry leaders, producers, and buyers to shape the next chapter of Africa’s remarkable tea story. With quality improvements, sustainable practices, and increasing value addition, the continent’s 750,000 metric tons are set to generate even greater economic and social impact in the years ahead.

Are you involved in Africa’s tea industry or planning to attend the Africa Coffee & Tea Expo 2025? Share your experiences in the comments below or contact us to feature your story in our upcoming special issue on African tea.